Mobile payments are more popular than ever. With just a tap on your phone, you can pay for groceries, order food or transfer money to a friend. While this convenience has made life easier, it has also opened up new opportunities for cybercriminals. Ensuring the security of mobile payments is essential to protect your financial data and personal information.

In this article, shall explore mobile payments security best practices, by highlighting common risks, and share actionable tips to help you stay safe and protected.

Understanding Mobile Payments Security

Mobile payments refer to transactions made using mobile devices, such as smartphones or tablets, through apps or digital wallets. Popular mobile payment services include Apple Pay, Google Pay, Samsung Pay, PayPal and Venmo. These platforms use various technologies, such as Near Field Communication (NFC), QR codes and online payment gateways.

While most mobile payment systems are designed with security features, users must also adopt best practices to safeguard their accounts and transactions. The combination of technology and user vigilance is key to creating a secure payment environment.

Common Mobile Payment Security Risks

Unsecured Networks

Using public Wi-Fi for mobile payments can expose your financial data to hackers. Cybercriminals often exploit unsecured networks to intercept sensitive information like passwords and payment details.

Phishing Attacks

Fraudulent emails, messages or websites trick users into sharing sensitive information, such as passwords or payment details. Phishing is one of the most common tactics used by cybercriminals.

Lost or Stolen Devices

If your phone falls into the wrong hands, your mobile payment apps and wallets could be at risk. Without proper security measures, someone could access your accounts and make unauthorized transactions.

Malware and Spyware

Malicious apps or software can access your financial data and compromise your transactions. Some malware is specifically designed to target payment apps.

Weak Passwords

Using easy-to-guess passwords can make your accounts vulnerable to unauthorized access. Cybercriminals often use automated tools to guess weak or common passwords.

Best Practices for Mobile Payments Security

1. Use Strong and Unique Passwords

Create strong, unique passwords for your mobile payment accounts. A strong password should include a mix of uppercase and lowercase letters, numbers and special characters. Avoid using easily guessed information like birthdays or names. Password managers can help you generate and store secure passwords.

2. Enable Two-Factor Authentication (2FA)

Two-factor authentication adds an extra layer of security by requiring a second verification step, such as a code sent to your phone or email. Most mobile payment apps offer 2FA and enabling it can significantly reduce the risk of unauthorized access.

3. Keep Your Software Updated

Ensure your mobile operating system, payment apps, and security software are always up to date. Updates often include patches for security vulnerabilities that hackers may exploit. Delaying updates can leave your device exposed to known threats.

4. Use Secure Networks

Avoid making mobile payments over public Wi-Fi networks. Instead, use a secure Wi-Fi connection or your mobile data network. For added security, consider using a Virtual Private Network (VPN) to encrypt your internet traffic. A VPN can protect your data even on public networks.

5. Install Apps from Trusted Sources

Only download mobile payment apps from official app stores like Google Play or the Apple App Store. Avoid third-party app stores, as they may host malicious apps designed to steal your data. Check app reviews and ratings to ensure their legitimacy.

6. Lock Your Device

Set up a strong screen lock for your smartphone, such as a PIN, password, or biometric lock (fingerprint or facial recognition). This can help protect your data if your device is lost or stolen. Screen locks are your first line of defense against unauthorized access.

7. Enable Remote Wipe Features

If your device is lost or stolen, a remote wipe feature allows you to erase all data on your phone, including mobile payment information. Services like Apple’s Find My iPhone or Google’s Find My Device offer this functionality. Activate this feature before an incident occurs.

8. Monitor Your Transactions

Regularly review your bank statements and mobile payment transaction history for any unauthorized or suspicious activity. Report any discrepancies to your bank or payment provider immediately. Early detection can prevent significant losses.

9. Avoid Sharing Payment Information

Be cautious about sharing your payment details or login credentials, even with people you trust. Scammers often impersonate friends or family to gain access to sensitive information. Sharing payment information over unsecured channels is particularly risky.

10. Educate Yourself About Phishing

Learn how to recognize phishing attempts, such as fake emails or messages that ask for personal or payment information. Always verify the sender’s identity before clicking on links or sharing details. Training yourself to spot phishing attempts can save you from falling victim to scams.

11. Use Biometric Authentication

Many mobile payment apps support biometric authentication, such as fingerprint or facial recognition. This adds an additional layer of security and makes it harder for unauthorized users to access your accounts. Biometric data is unique to you and difficult to replicate.

12. Enable App Notifications

Set up notifications for your mobile payment apps to receive alerts for every transaction. This helps you stay informed and take immediate action if you notice any suspicious activity. Notifications act as real-time monitoring tools for your accounts.

Real-World Examples of Mobile Payment Security Breaches

- Starbucks App Breach (2014)

Hackers accessed customer accounts by guessing weak passwords and used stored payment information to make unauthorized purchases.

Lesson Learned: Use strong, unique passwords and avoid saving payment details unnecessarily. - Zelle Phishing Scams (2022)

Scammers used phishing messages to trick users into transferring money via Zelle.

Lesson Learned: Always verify the recipient’s identity before completing a transaction. - Cash App Data Breach (2022)

A former employee accessed sensitive user data, including names, brokerage account numbers and portfolio information.

Lesson Learned: Choose payment platforms that prioritize data security and restrict employee access.

How Mobile Payment Providers Ensure Security

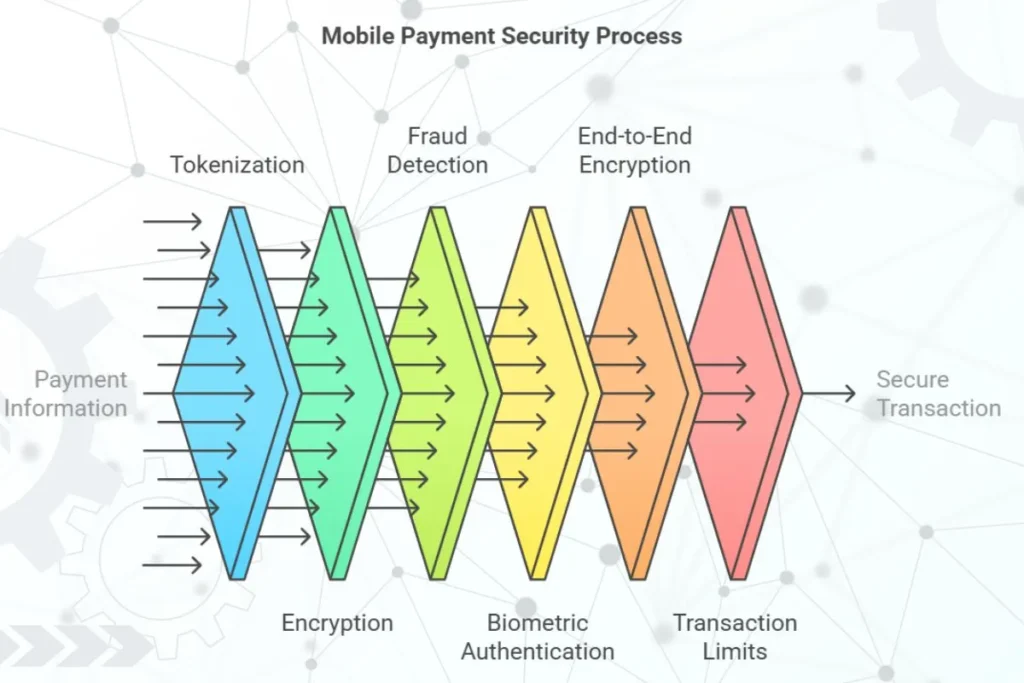

Most mobile payment providers implement advanced security features to protect users:

- Tokenization: Replaces sensitive payment information with a unique token during transactions, ensuring that real data isn’t exposed.

- Encryption: Secures data during transmission to prevent interception by hackers.

- Fraud Detection Systems: Monitors transactions for unusual activity and flags potential fraud.

- Biometric Authentication: Adds a layer of security with fingerprint or facial recognition.

- End-to-End Encryption: Ensures that data is secure from the sender’s device to the recipient’s device.

- Transaction Limits: Restricts large transactions unless additional verification is provided.

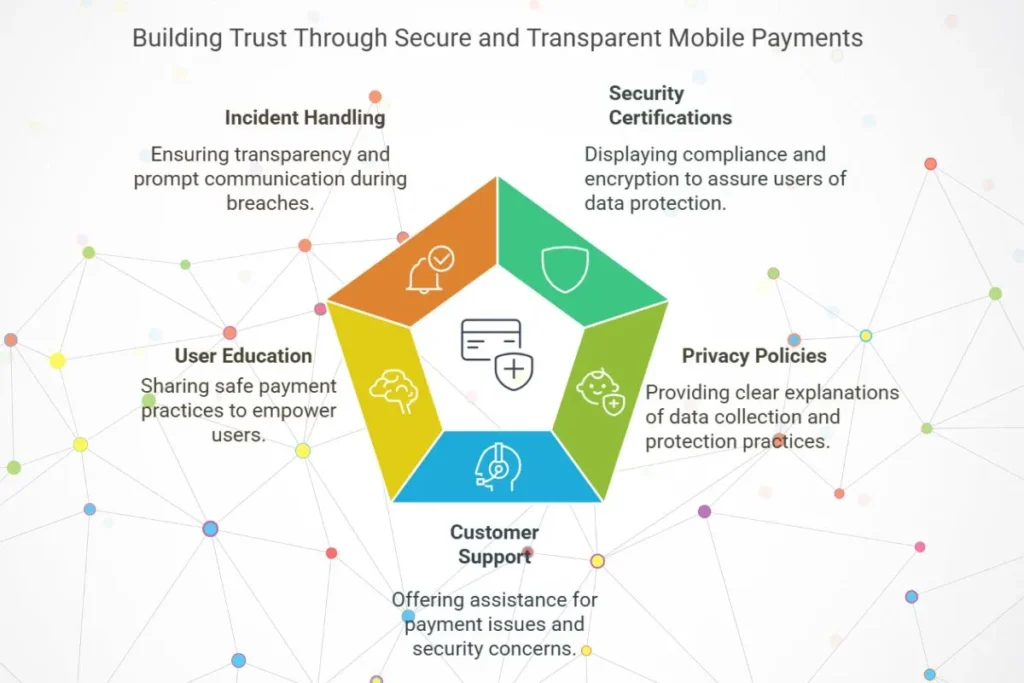

Building Trust Through Secure Mobile Payments

Customers are more likely to use mobile payment options if they trust their data will be secure. Here’s how businesses can build trust:

- Display Security Certifications: Highlight security measures, such as PCI-DSS compliance or encryption, on your app or website.

- Provide Clear Privacy Policies: Explain how user data is collected, stored and protected.

- Offer Customer Support: Provide assistance for users experiencing payment issues or security concerns.

- Educate Users: Share tips for safe mobile payment practices through in-app notifications, emails or blog posts.

- Transparent Incident Handling: Notify users promptly in case of a breach and explain steps taken to address it.

Conclusion

Mobile payments are convenient and secure when users follow best practices and remain alert against potential threats. By using strong passwords, enabling 2FA, avoiding public Wi-Fi and staying informed about security risks, you can protect your financial data and enjoy the benefits of mobile payments with peace of mind.

Take action today to enhance your mobile payment security. It’s not just about protecting your money, but it’s about safeguarding your digital identity in this connected world. Businesses and individuals both must prioritize security to build a safer digital ecosystem for everyone.