Now a days Identity theft has become one of the biggest fears as technology becomes increasingly incorporated into our personal and financial lives. With hackers getting smarter and new viruses emerging daily, it has become more important to protect your identity on cyber world.

In this cybersecurity guide, we shall explain what is identity theft and how to protect yourself, also we shall discuss about the warning signs and security measures to avoid falling victim to these cyberattacks.

What is Identity Theft?

Identity theft occurs when someone uses your personal information to commit fraud or other crimes. This can be like opening new credit card accounts to make large purchases or even stealing your Social Security number to commit tax fraud. Hackers can cause financial damage, damage to your reputation and even legal troubles.

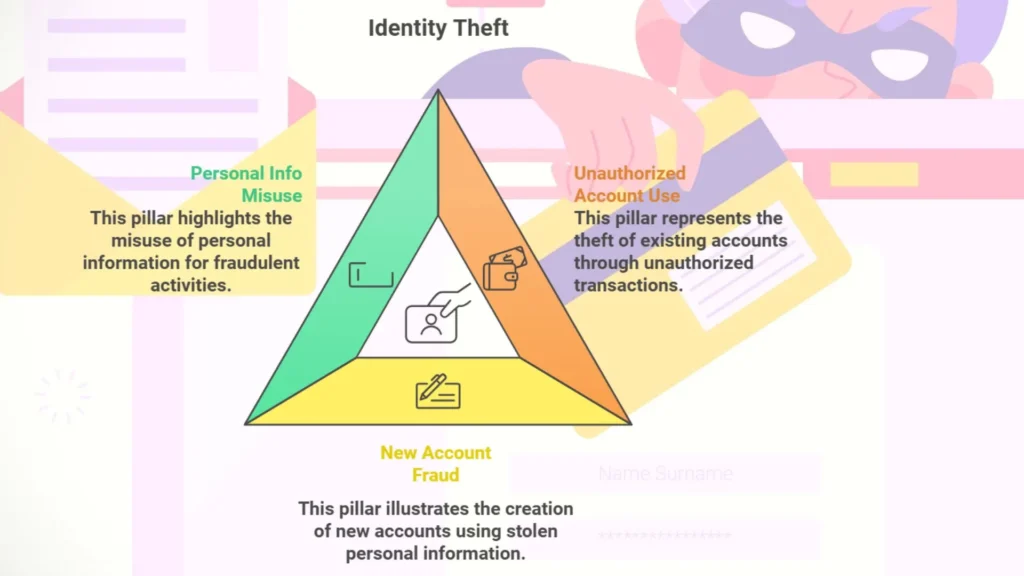

According to the Bureau of Justice Statistics, identity theft falls into three categories:

1. Unauthorized use of an existing account: This uses someone’s credit card or bank account without their permission.

2. Opening new accounts with stolen information: This uses your personal information to create new accounts or take out loans in your name.

3. Misusing personal information for fraudulent purposes: Hackers may use your Social Security number or other details to make tax fraud or to apply for government benefits.

The Rise of Identity Theft

The problem of identity theft has been increasing rapidly. According to the 2017 Identity Fraud Study by Javelin Strategy & Research, the number of identity theft victims rose from 13.1 million in 2015 to 15.4 million in 2016, a 17% increase. By today it has increased many folds. Hackers are continuously improving their techniques. Which makes it more important for consumers to stay alert and protect their information.

What is at Risk?

Identity theft hackers access your email or open credit card accounts in your name. They can also:

– Hold your data for ransom: Some hackers steal or encrypt your data and then demand money (ransomware) to get it back.

– Steal large sums of money: In 2016, hackers stole over $16 billion from consumers through identity theft and fraud, according to Javelin Strategy & Research. By todays standard, it has increased many folds!

Who is at Risk?

Surprisingly, identity theft can happen to anyone, from tech savvy individuals to those who are less familiar with technology. Even people who use strong passwords are at risk, especially if they use the same password across multiple accounts.

– Millennials are generally better at protecting themselves, as they have grown up with technology and understand the importance of security.

– Generation X (born 1965-1980) is the most vulnerable to identity theft since they don’t follow proper security practices and take unnecessary risks online.

How to Protect against Identity Theft

Here are some practical steps you can take to protect yourself from identity theft:

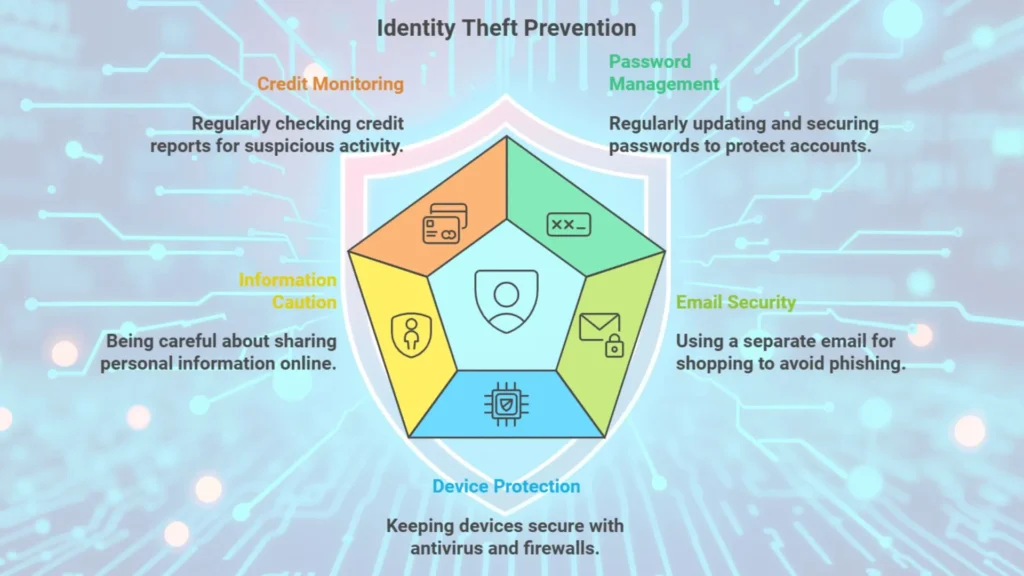

1. Change Your Passwords Regularly

Use strong, unique passwords for every account, combine upper and lowercase letters, numbers and special symbols. Don’t use personal information like birthdays or names. Change your passwords at least every six months. This is especially important for financial accounts. Set up two factor authentication (2FA) for enhanced security.

2. Create a Separate Email for Shopping

If you frequently shop online, then create a separate email address specifically for online shopping. This helps to protect your main email address from phishing attacks and reduces the risk of hackers accessing your personal information through your shopping history.

3. Secure Your Devices

Make sure all your devices, including computers and smartphones, have up to date antivirus and anti malware software installed. Additionally, enable firewalls to create an extra layer of protection against hackers who try to access your personal information. Install and update security software on all your devices.

4. Be Careful with Personal Information

Be careful about where you share your personal information. Don’t give out your Social Security number, bank account details or other sensitive information over email or unsecured websites. Hackers are becoming more sophisticated and trick people into give away personal data. Learn how to avoid phishing scams and suspicious emails.

5. Monitor Your Credit Reports Regularly

Regularly review your credit report for any suspicious activity. Most credit card companies offer free access to your credit report, which can help you to detect unusual transactions early. If you notice anything suspicious, you can freeze your credit card immediately. This will prevent hackers to open new accounts in your name until the issue is resolved.

What to Do If You Suspect Identity Theft

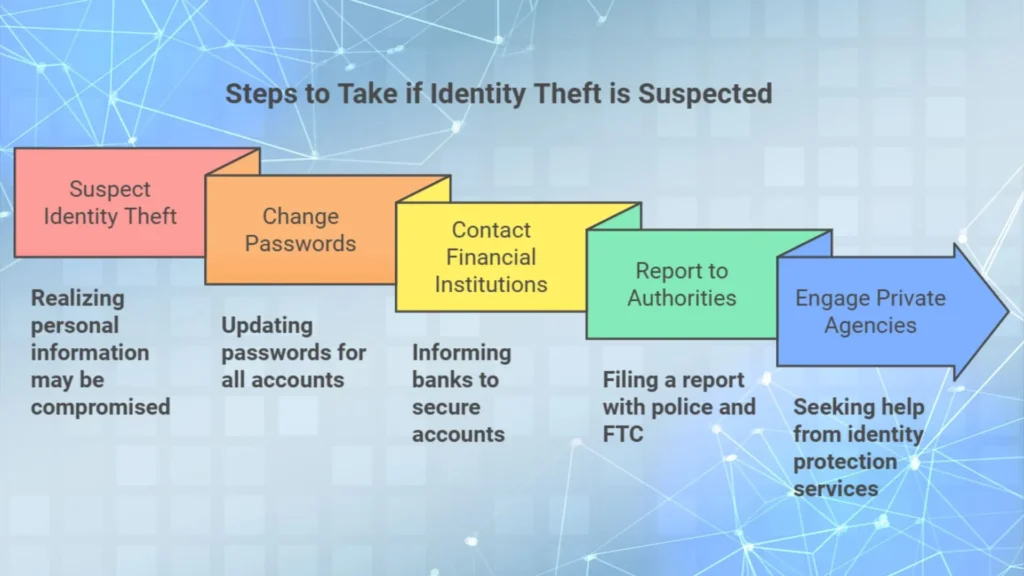

If you think your identity has been stolen or compromised, act quickly and take following actions:

1. Change your passwords:

Immediately change the passwords for all accounts. Do this to all accounts, especially those involving financial information.

2. Contact financial institutions:

If your credit card or bank information has been stolen, contact your bank immediately. They will freeze your accounts and prevent unauthorized transactions.

3. Report to authorities:

If your Social Security number or other important personal data has been compromised, file a police report and notify the Federal Trade Commission (FTC) or respective Government Authority. They will take the necessary steps to protect your identity.

Private Agencies are specialized in protecting data and preventing identity theft. They offer a range of services designed to keep your private information safe.

Conclusion

With identity theft on the rise, it has become more important to protect your personal and financial information. By following these security practices, you can reduce your risk of becoming a victim and keep your private data safe from hackers.