Artificial Neural Networks (ANNs) have become an essential part of the financial sector, by innovations and improving efficiency in various domains. Artificial Neural Networks mimic the structure of the human brain and analyze complex datasets, recognize patterns and make predictions with high accuracy. For finance professionals, ANNs provide powerful tools for tackling challenges like risk assessment, fraud detection, customer segmentation and stock market predictions.

This post explains the most impressive applications of artificial neural networks in finance, supported by real world examples and case studies from leading financial institutions. This guide will provide a comprehensive understanding of how neural networks are reshaping the industry.

What are the Applications of Artificial Neural Networks in Finance

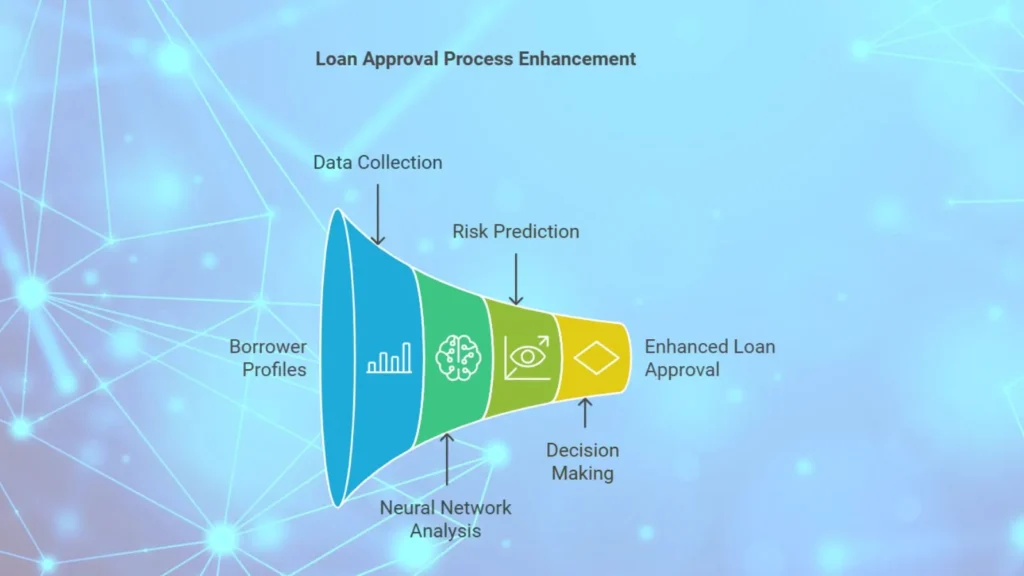

1. Predictive Modeling for Risk Assessment in Loan Approval

Neural networks are widely used for risk assessment in lending and investment decisions. Financial institutions use ANNs to analyze credit history, income and other relevant factors to predict the likelihood of loan defaults or assess the risk associated with investments.

– Example: Wells Fargo utilizes neural networks for credit risk assessment. By using ANNs to evaluate borrower profiles, the bank can make faster, more accurate lending decisions, which reduces the risk of loan defaults while improving the approval process for customers.

2. Customer Segmentation and Personalized Marketing

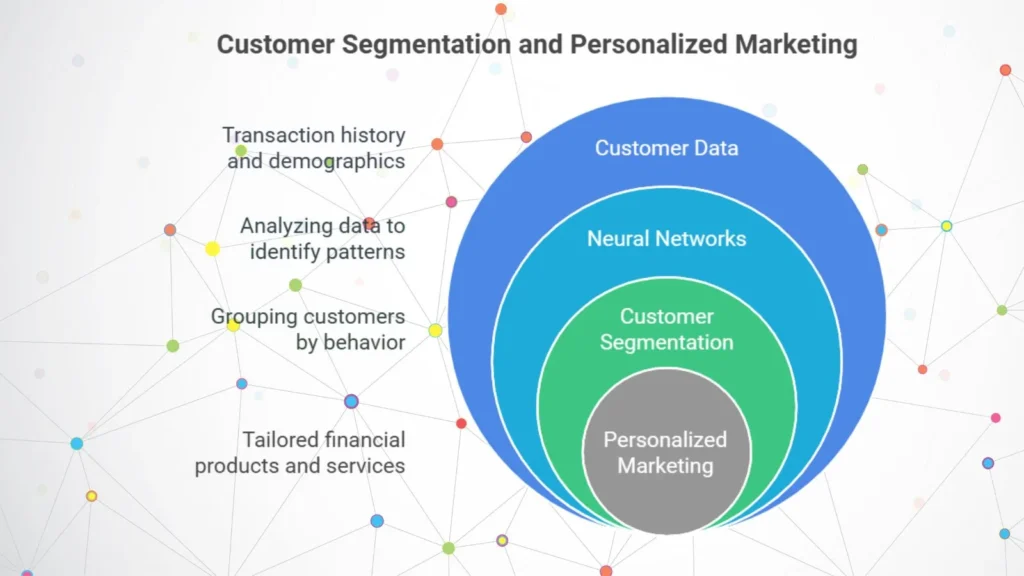

Understanding customer behavior and preferences is very important for financial institutions. Neural networks play a significant role in customer segmentation and personalized marketing by analyzing customer data and categorizing individuals into different segments. This segmentation enables financial institutions to target customers with matched products and services.

How Neural Networks Enable Precise Customer Segmentation

Neural networks can process large volumes of customer data, including transaction history, demographic information and online behavior. By identifying patterns in this data, financial institutions divide customers into groups based on factors like spending habits, risk tolerance and product preferences.

– Example: Citibank uses neural networks for customer segmentation in its marketing campaigns. By segmenting customers based on their spending behavior and preferences, Citibank can deliver personalized offers, to boost customer engagement and loyalty.

Personalized Marketing Campaigns with ANNs

Once customers are segmented, neural networks help to personalize marketing campaigns. For instance, a bank might target high value customers with premium credit card offers, while sending investment advice to customers who exhibit a high interest in financial planning.

– Example: American Express employs neural networks to analyze customer purchasing patterns and suggest relevant products. This approach has led to increased customer engagement and improved conversion rates for their marketing efforts.

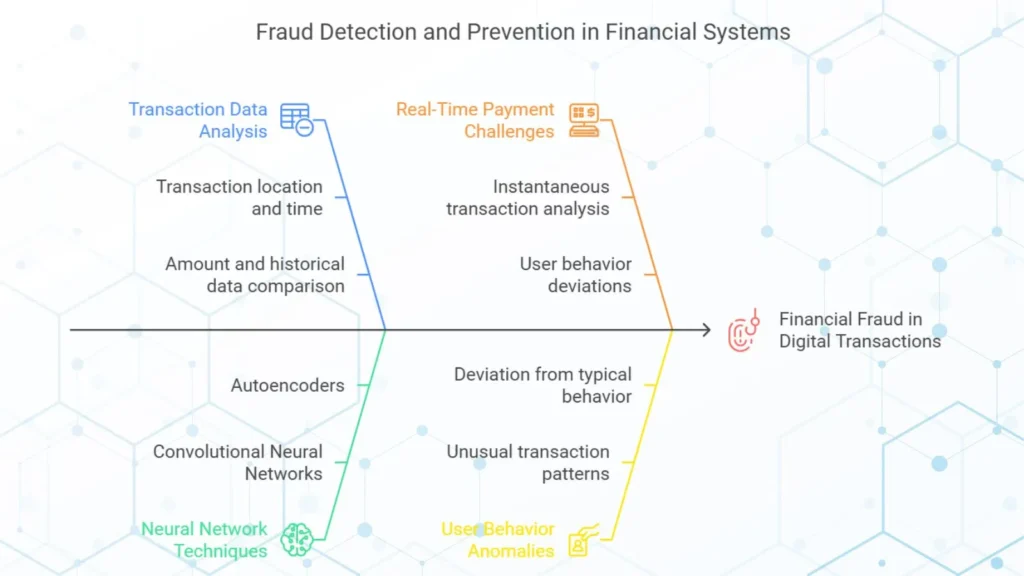

3. Fraud Detection and Prevention

Financial fraud is a growing concern in today market. Fraudulent transactions and theft can lead to significant losses for both institutions and customers. Neural networks have become a powerful tool in fraud detection, which helps financial institutions to identify and prevent fraudulent activities in real time.

How Neural Networks Detect Fraud

Neural networks, particularly Convolutional Neural Networks (CNNs) and Autoencoders, can analyze vast amounts of transaction data to detect unusual patterns that may indicate fraud. They examine variables such as transaction location, time and amount and compare them against historical data to identify anomalies.

– Example: Visa uses neural networks to detect potentially fraudulent transactions. By analyzing patterns in real time, Visa’s AI driven fraud detection system can pin-point suspicious activity and prevent fraud before it happens.

Case Study: Fraud Prevention in Real Time Payments

With the rise of digital and mobile payments, real time fraud detection has become essential. Financial institutions use ANNs to analyze transactions as they occur, to flag any activity that deviates from typical user behavior.

– Example: HSBC developed an AI based fraud detection system that uses neural networks to analyze transactions in real time. This system reduces false positives. This means fewer legitimate transactions are flagged as suspicious, which improves the customer experience while enhancing security.

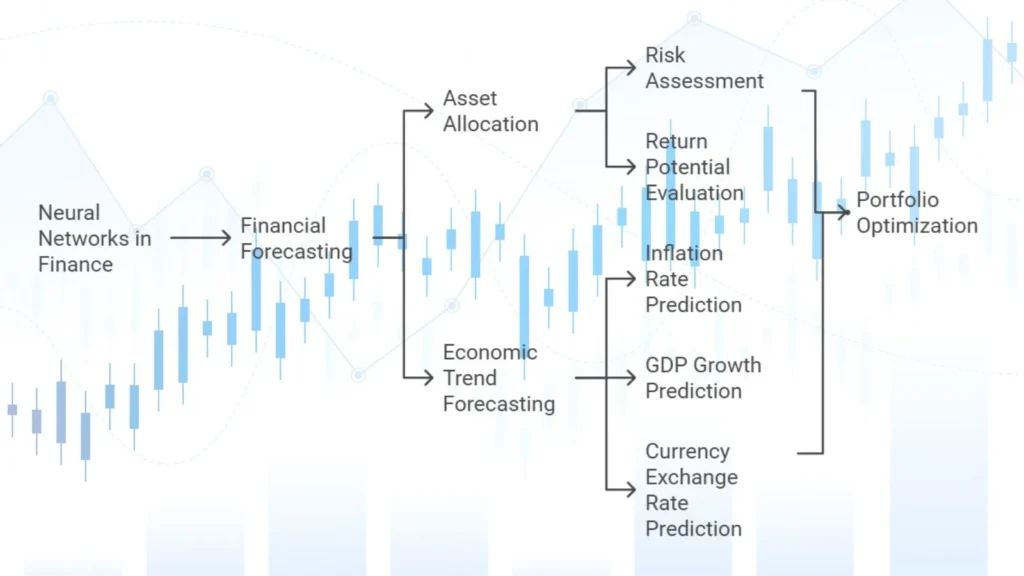

4. Financial Forecasting and Portfolio Management

Another major application of neural networks in finance is financial forecasting. Accurate forecasts help financial institutions to make informed decisions regarding asset allocation, market timing and portfolio management. Neural networks are capable of predicting trends and analyzing complex financial data.

How Neural Networks Assist in Portfolio Management

Neural networks use predictive modeling to assess the risk and potential return of different investments. This allows portfolio managers to optimize asset allocation, according to investor goals and market conditions by balancing risk and return.

– Example: BlackRock, one of the largest asset management firms globally, uses machine learning, including neural networks, for portfolio optimization. BlackRock’s AI driven models help portfolio managers to make investment decisions based on data.

Forecasting Economic Trends with ANNs

Financial institutions also use neural networks to forecast economic indicators, such as inflation rates, GDP growth and currency exchange rates. By processing historical and current data, ANNs can provide forecasts that guide investment and business decisions.

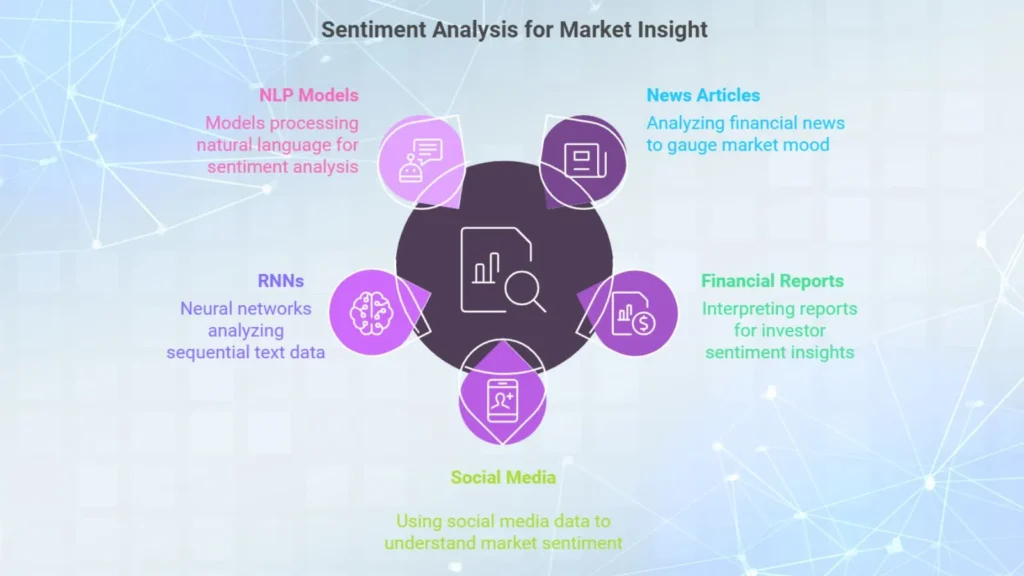

5. Sentiment Analysis for Market Insight

Understanding investor sentiment can be a valuable tool for financial institutions. Sentiment analysis involves analyzing text data, such as news articles, financial reports and social media, to gauge the market mood. Neural networks, particularly Recurrent Neural Networks (RNNs) and Natural Language Processing (NLP) models, excel at interpreting unstructured text data for sentiment analysis.

How Sentiment Analysis Supports Investment Decisions

By analyzing the tone of financial news, tweets and other sources, neural networks can provide insights into investor sentiment. This helps financial institutions to make investment decisions based on data, which aligns with market sentiment to optimize returns.

– Example: Goldman Sachs uses sentiment analysis in its investment strategy. By leveraging AI to analyze news and social media sentiment, Goldman Sachs can better understand market trends and adjust its portfolio accordingly.

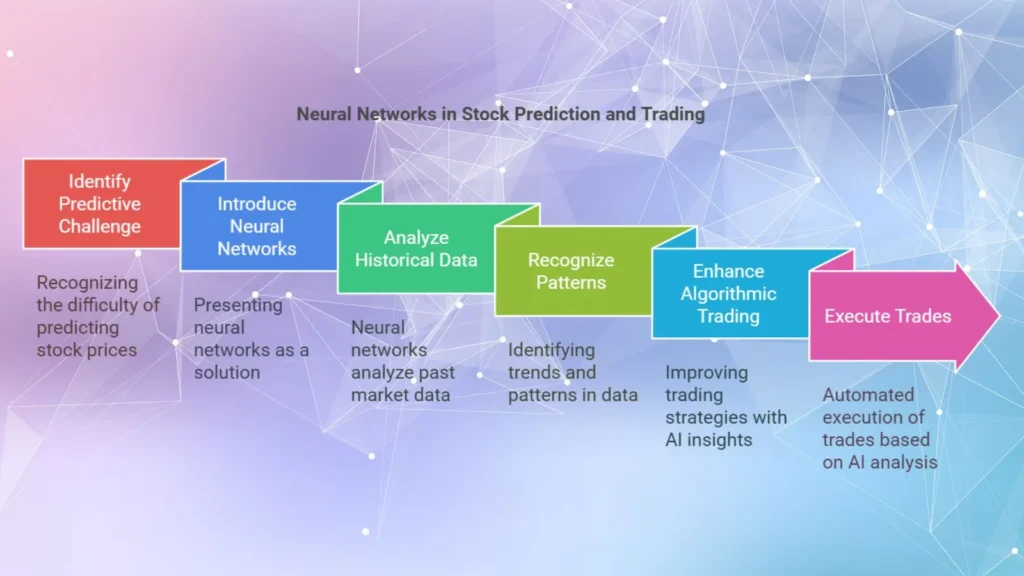

6. Predictive Modeling for Stock Prices and Algorithmic Trading

Predicting stock prices is one of the most challenging tasks in finance. Stock markets are influenced by numerous unpredictable factors, from global economic events to investor sentiment. Traditional models like linear regression have limitations when it comes to handling such complex, non linear relationships. This is where neural networks come into play.

How Neural Networks Improve Stock Price Predictions

Neural networks, especially Recurrent Neural Networks (RNNs) and Long Short-Term Memory (LSTM) models, excel at analyzing time series data, which makes them well suited for stock price predictions. By analyzing historical data, they can recognize patterns and trends that humans or traditional algorithms might miss.

– Example: JPMorgan Chase uses AI driven predictive modeling to analyze market data and develop trading strategies. By using neural networks, the bank can assess market conditions and generate predictions to help traders to make decisions based on information.

How Neural Networks Power Algorithmic Trading

Algorithmic trading uses computer programs to execute trades automatically based on predefined rules and conditions. Neural networks enhance algorithmic trading by enabling more sophisticated decision making and pattern recognition.

Neural networks analyze large amounts of market data, to identify patterns that can indicate profitable trades. ANNs are used to develop high frequency trading algorithms, which execute multiple trades in milliseconds to take advantage of small market fluctuations.

– Example: Renaissance Technologies, a hedge fund known for its use of AI, employs neural networks and machine learning models to drive its algorithmic trading strategies. This approach has led to consistently high returns. This strategy has set Renaissance Technologies apart in the finance industry.

Conclusion

Artificial Neural Networks are transforming the financial sector, by enabling institutions to use the power of big data and make more informed decisions. By using predictive modeling, fraud detection, sentiment analysis and algorithmic trading, neural networks have revolutionized financial services, to improve efficiency and accuracy.

For financial institutions, the future lies in using neural networks and other AI technologies to stay competitive, reduce risks and offer personalized services to customers. As AI technology continues to advance, we can expect neural networks to play more integral role to shape the future of finance.