The finance sector has long been known for its decision making strategy based on analyzed data. The recent surge in machine learning (ML) applications has added powerful new tools for analyzing data at a very large speed and accuracy. From stock market predictions to fraud detection, machine learning is transforming how financial institutions manage risks, optimize portfolios and deliver personalized customer experiences.

In this blog post, we shall explain what is the role of machine learning in finance, explore specific applications and review case studies from major financial institutions who use AI for competitive advantage.

Why Machine Learning is Important in Finance

The amount of data generated in finance is very large, with daily transactions, market data and client information accumulating across banks, investment firms and insurance companies. This data holds the key to information that can help to predict future trends, detect irregularities and optimize decision making. Machine learning models can quickly identify patterns in these data points, which makes them valuable for applications such as:

– Predicting stock prices

– Detecting and preventing fraud

– Optimizing investment portfolios

– Enhancing customer service with personalized financial advice

Machine learning helps financial institutions to make proactive, data driven decisions that keep up with market shifts, regulatory updates and customer needs.

Key Applications of Machine Learning in Finance

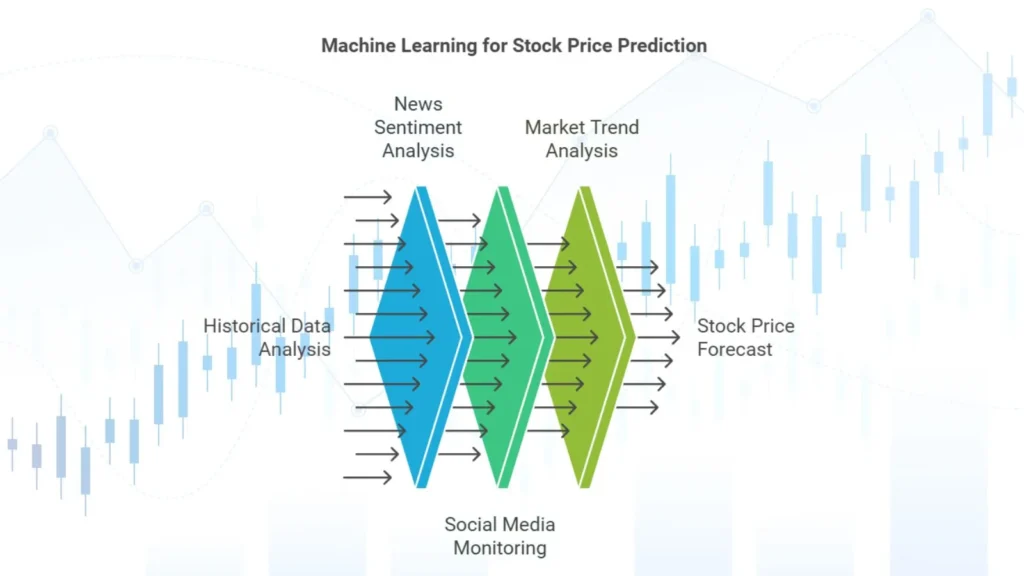

1. Stock Price Prediction

Predicting stock prices is one of the most challenging aspects of finance due to the vast number of variables that impact market performance. ML algorithms, particularly deep learning and Recurrent Neural Networks (RNNs), can analyze historical data, news headlines, market trends and social media sentiment to forecast stock prices. By training on large datasets, these algorithms can recognize patterns and correlations that humans might overlook.

Example: Quant Hedge Funds

Quantitative hedge funds, like Renaissance Technologies and Two Sigma, use proprietary machine learning algorithms to analyze massive datasets, from price histories to economic indicators, to beat traditional investment strategies.

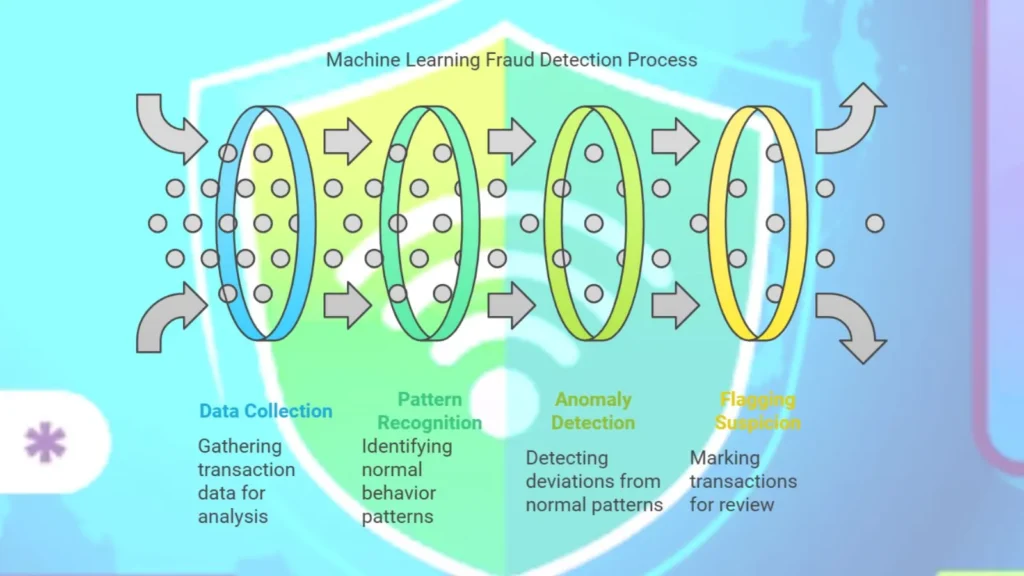

2. Fraud Detection and Prevention

Fraud detection is a very important area where ML has proven especially beneficial. Traditional rule based fraud detection systems are often inefficient as they struggle to keep up with evolving fraud tactics. However, ML can analyze millions of transactions in real time, which recognizes suspicious behavior patterns as an indication of fraud.

– How It Works: ML models are trained to identify unusual patterns by examining historical fraudulent transactions. For instance, if a customer’s spending behavior suddenly shifts drastically, the system can pin-point this as suspicious activity for further investigation.

Case Study: PayPal

PayPal uses ML algorithms to detect potentially fraudulent transactions by recognizing deviations from a user’s normal transaction patterns. For example, an unusually large transaction from a new location may trigger an alert for further inspection.

3. Portfolio Optimization

Machine learning models can optimize investment portfolios by analyzing market conditions and balancing risk and reward for investors. ML algorithms like reinforcement learning continuously adjust portfolios in response to market changes and customer preferences, aiming to achieve the best possible returns.

Example: BlackRock’s Aladdin Platform

BlackRock’s Aladdin platform uses machine learning to provide real time portfolio management information for asset managers. By analyzing large amounts of market data, the platform helps financial advisors to suggest allocations that maximize returns while staying within acceptable risk levels.

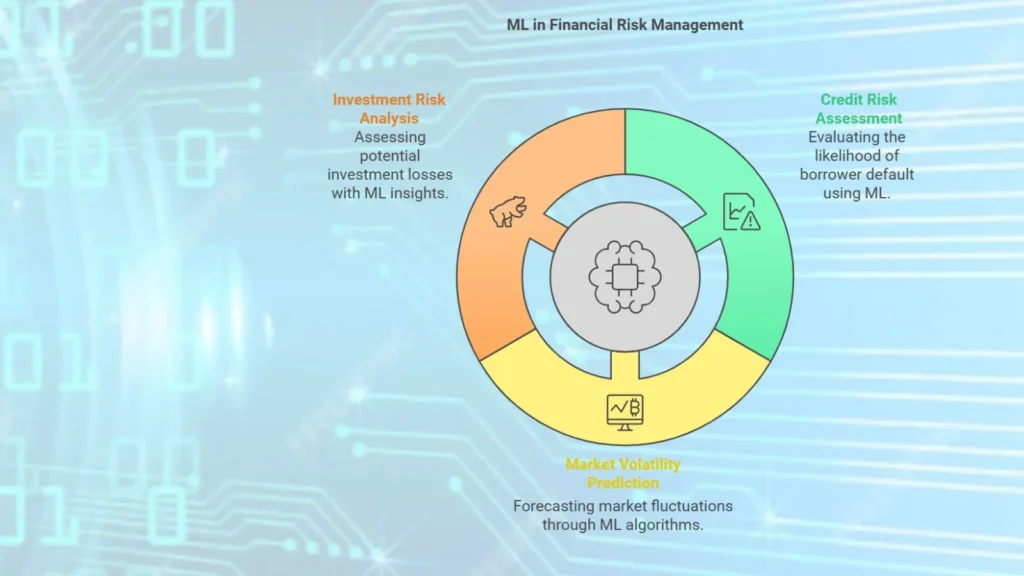

4. Risk Management

Financial institutions face a variety of risks, from credit risk to operational risk. ML models can analyze a large array of data points, such as market trends, credit histories and financial reports, to create more accurate risk profiles and improve decision making.

– How It Works: Risk models rely on ML algorithms to calculate the probability of default on loans, market volatility and investment risks. These insights allow financial firms to allocate capital wisely and prepare for adverse scenarios.

Case Study: JPMorgan Chase

JPMorgan Chase’s COiN (Contract Intelligence) program uses machine learning to analyze thousands of complex legal documents for risk assessment purposes, which significantly reduced manual review time. This AI tool has saved the bank hundreds of thousands of labor hours and minimized risks associated with contract errors.

Machine Learning in Customer Focused Applications

Beyond risk and fraud management, machine learning has made significant strides in personalizing customer experiences in finance. Let’s explore two major customer-focused applications: personalized financial advice and customer segmentation.

1. Personalized Financial Advice

Machine learning analyzes customer transaction history, investment preferences and financial goals to deliver personalized advice. By anticipating a customer’s needs based on data patterns, financial advisors can proactively suggest products that align with the customer’s profile.

Case Study: Wealthfront and Robo-Advisors

Wealthfront, a leading robo-advisory platform, uses ML algorithms to provide financial advice and automate investment management. By analyzing risk tolerance and financial goals, Wealthfront’s algorithm determines a personalized investment strategy, to adjust portfolios based on market performance.

2. Customer Segmentation and Marketing

Understanding customer behavior is essential for effective marketing in finance. Machine learning helps financial institutions to make customer segmentation based on behavior, preferences and risk profiles. This enabled them to make targeted marketing efforts that maximize conversion rates.

Example: Customer Retention Strategies

Banks use machine learning to identify customers likely to leave and take preemptive action by offering incentives or improved services. Predictive models help to analyze customer feedback, product usage patterns and service satisfaction, which enables to make retention strategies that increase customer loyalty.

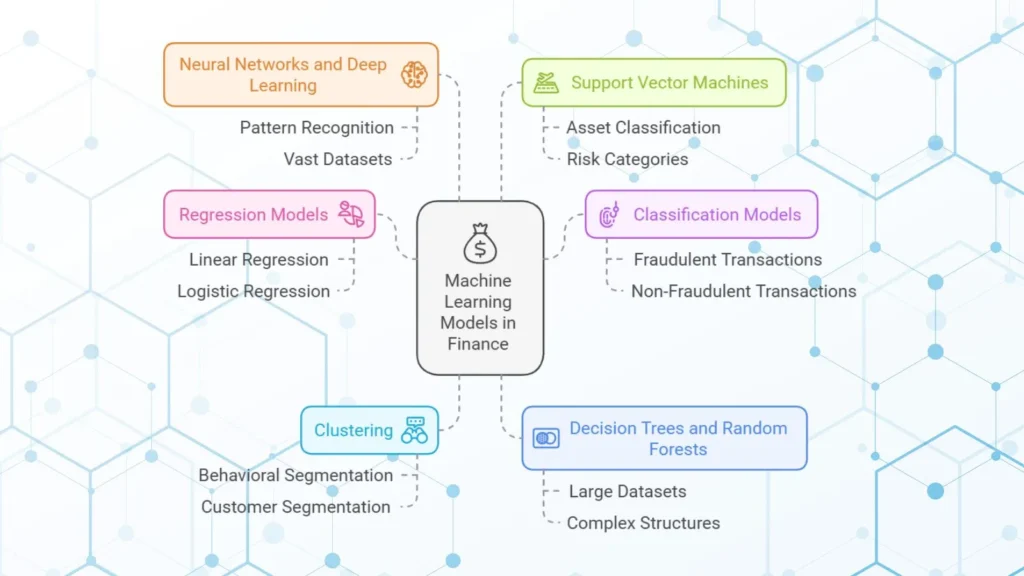

Machine Learning Models Commonly Used in Finance

Different machine learning models are employed depending on the financial application. Here are a few of the most popular:

– Linear and Logistic Regression:

Often used in risk assessment and customer segmentation.

– Classification Models:

Helps to categorize data into classes (e.g., fraudulent vs. non-fraudulent transactions).

– Clustering:

Groups customers based on similar behavior, which is useful for customer segmentation.

– Decision Trees and Random Forests:

Suitable for credit scoring and fraud detection as they handle large datasets with complex structures.

– Neural Networks and Deep Learning:

Used in applications like stock prediction and high frequency trading, where patterns in large datasets need to be identified.

– Support Vector Machines (SVM):

Helpful in portfolio optimization by classifying assets into high and low risk categories.

Each model brings distinct advantages and many financial institutions use a combination to achieve optimal accuracy and efficiency.

Case Studies of Machine Learning in Finance

1. Goldman Sachs: High Frequency Trading

Goldman Sachs uses machine learning to power its high frequency trading systems, which allows it to execute trades in microseconds based on market signals. These algorithms make trades on small price differences, which generate substantial returns due to their speed and accuracy.

2. Zest AI: Credit Scoring and Loan Approval

Zest AI, a financial technology company, uses machine learning to improve credit scoring for loan approvals. By analyzing thousands of factors, Zest’s algorithms assess credit risk more comprehensively than traditional credit scoring methods, which allows lenders to make fairer lending decisions and avoid underserved customers.

3. American Express: Fraud Detection

American Express has developed a machine learning based fraud detection system that analyzes transaction patterns, user location and other variables to detect fraud. This system has successfully reduced false positive rates, which saved time and money for customers and the company.

Benefits of Machine Learning in Finance

Machine learning provides many benefits to the financial sector, including:

– Accuracy: Improved accuracy in predictive modeling and decision making.

– Efficiency: Reduced operational costs through automation and optimized processes.

– Real time Analysis: Fast data processing allows real time decision making, which is very important in trading and fraud prevention.

– Personalization: Matching financial products improve customer satisfaction and loyalty.

– Scalability: Models can handle large amounts of data, which makes them ideal for global financial operations.

Challenges and Ethical Considerations

While machine learning offers incredible benefits, it also presents challenges and ethical issues:

1. Data Privacy:

Financial data is sensitive and algorithms must comply with data privacy regulations, such as GDPR.

2. Bias in Algorithms:

Poorly designed models can reflect biases, which leads to unfair decisions, such as biased credit scoring.

3. Model Interpretability:

Complex models like deep neural networks are often “black boxes,” which make it difficult to explain the decision making process.

4. Risk of Overfitting:

Models trained on historical data may not adapt well to new, unforeseen market conditions.

5. Data Quality:

ML models are only as good as the data they are trained on. Inconsistent or biased data can lead to incorrect predictions, leading to financial losses or poor risk assessment.

6. Ethical and Legal Concerns:

Algorithms used for credit scoring or loan approval raise ethical questions, as ML systems can inadvertently carry on biases present in historical data.

Financial institutions must carefully balance machine learning’s advantages with the ethical implications to ensure fair and transparent services.

Future of Machine Learning in Finance

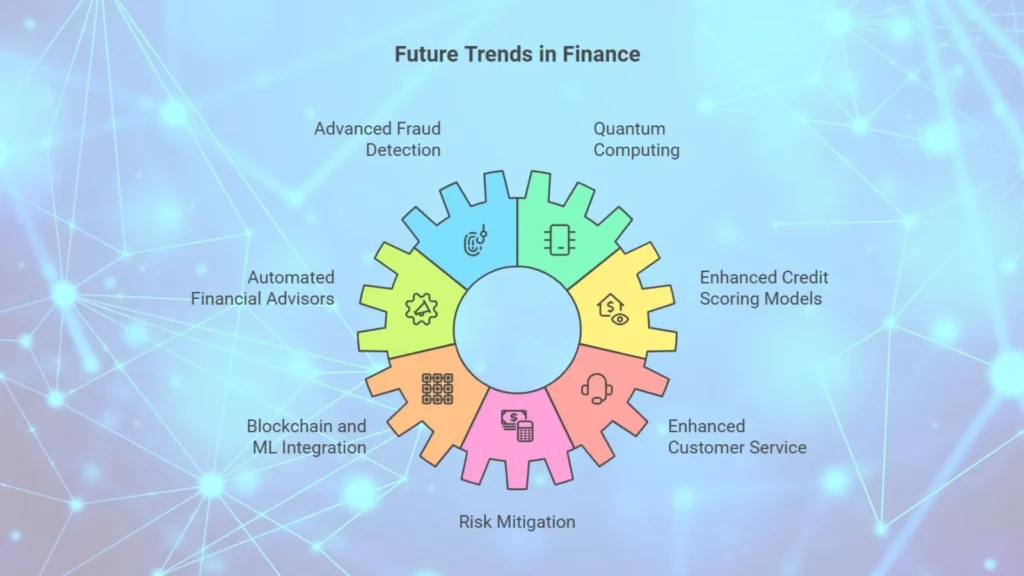

As ML continues to evolve, it will unlock even more possibilities in finance. Here are some future trends to watch for:

1. Advanced Fraud Detection:

With the rise of deep learning, fraud detection systems will become more sophisticated, which will accurately identify complex fraud patterns.

2. Quantum Computing:

The development of quantum computing could exponentially increase the capabilities of predictive algorithms, to make them faster and more accurate.

3. Automated Financial Advisors:

Robo advisors will become more advanced, which will offer sophisticated, AI driven advice suitable to each individual’s financial needs.

4. Enhanced Credit Scoring Models:

ML will create better credit scoring models, factoring in non traditional data like social media activity or online behavior, expanding access to financial services.

5. Blockchain and ML Integration:

Blockchain technology, coupled with ML, may enhance transparency in financial transactions, reduce fraud and improve trust among financial institutions.

6. Enhanced Customer Service:

AI driven chatbots and virtual assistants will likely become more sophisticated, to offer personalized, real time advice.

7. Risk Mitigation:

Advanced machine learning models will better predict economic downturns, which enables financial institutions to take preemptive action.

Conclusion

Machine learning is redefining finance sector by enabling advanced predictive analytics, personalized services and automated risk management. Financial institutions like major banks or fintech startups, all are using ML to optimize operations and enhance customer experiences. However, as ML becomes more popular in the sector, ethical and regulatory considerations will also increase, highlighting the need for transparency and accountability.

As machine learning technology continues to advance, it is set to transform finance even further, driving innovation, increasing efficiency and shaping the future of financial services.