Now a days, frauds have become increasingly sophisticated, as the fraudsters are using advanced techniques to deceive organizations and individuals. As a result, traditional methods of fraud detection, are often insufficient to keep up with evolving schemes. This is where machine learning (ML) steps in, to make innovative approaches as how to detect and prevent fraud before it causes significant damage.

This article explores the role of machine learning in fraud detection, covering popular techniques, key algorithms and real world applications, particularly in industries like e-commerce and banking.

What Is The Role of Machine Learning in Fraud Detection?

Machine learning in fraud detection involves using algorithms to analyze and learn from historical data, which enables systems to automatically identify suspicious patterns and behaviors. By processing large amounts of transaction and user data, ML algorithms can flag potentially fraudulent activities in real time, which helps businesses to reduce financial losses and improve overall security.

Why Machine Learning used for Fraud Detection?

Machine learning offers several advantages over traditional fraud detection methods, including:

– Real time Detection: ML models can analyze transactions as they occur, by identifying unusual behavior immediately.

– Improved Accuracy: By continuously learning from new data, ML models adapt to emerging fraud techniques.

– Reduction of False Positives: Machine learning models can more accurately distinguish between legitimate and fraudulent transactions, which reduces unnecessary or false alerts.

Key Techniques for Fraud Detection Using Machine Learning

1. Supervised Learning (Classification)

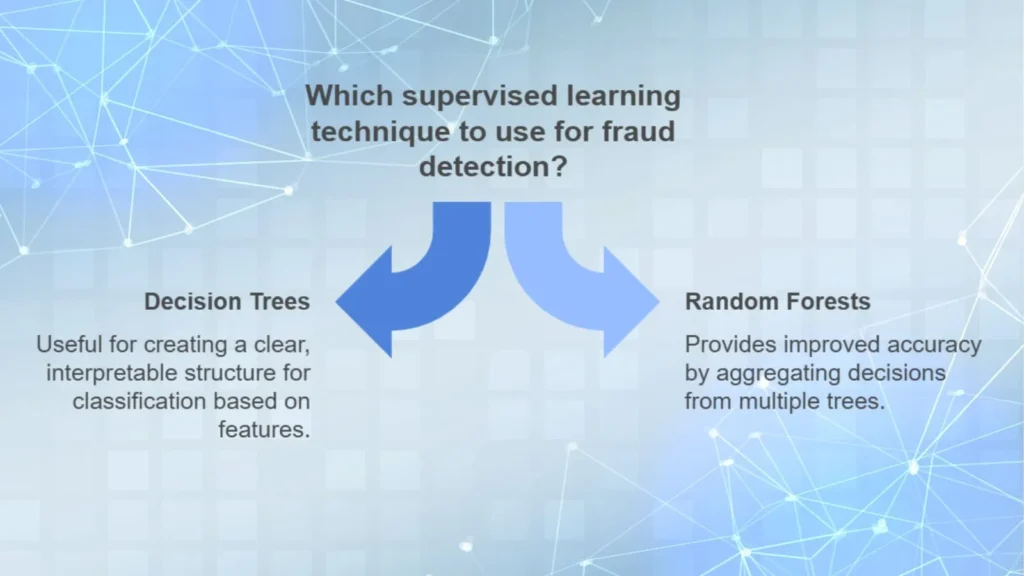

Supervised learning is one of the most common approaches, where models are trained using labeled datasets. Each transaction in the dataset is tagged as either “fraudulent” or “non-fraudulent.” Popular supervised techniques include:

– Decision Trees: Decision trees create a flowchart like structure that helps to classify transactions based on specific features. If a transaction matches certain patterns, it is flagged as suspicious.

– Random Forests: An extension of decision trees, random forests use multiple decision trees to improve accuracy. It provides a majority decision based on votes from each tree.

2. Unsupervised Learning (Anomaly Detection and Clustering)

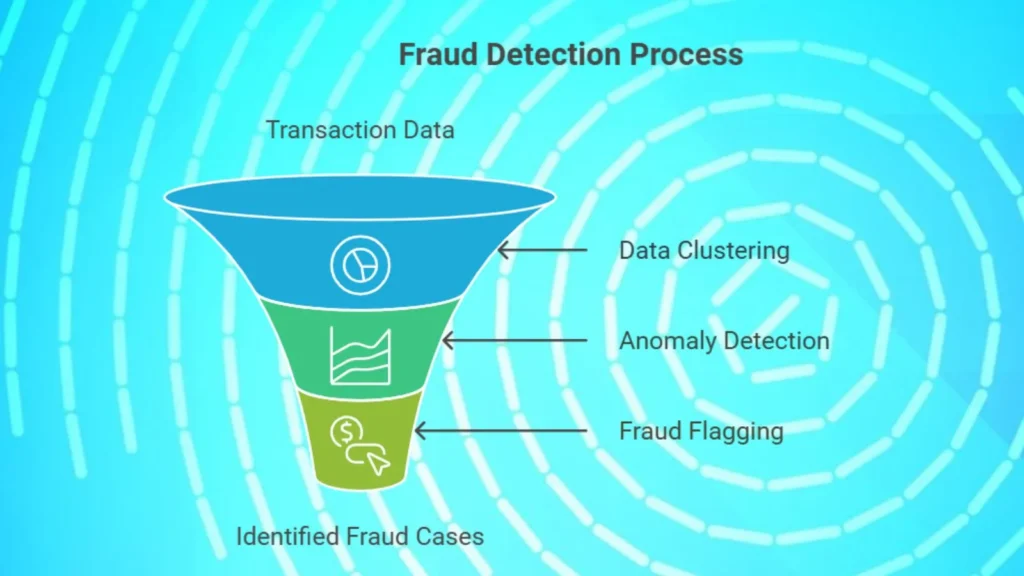

Unsupervised learning techniques identify fraud by detecting anomalies in data patterns, which makes them highly valuable for unknown fraud patterns:

– Clustering: Clustering groups data into clusters based on similar characteristics. When a transaction falls outside these clusters, it may be flagged as fraud. Techniques like K-means and hierarchical clustering are common in fraud detection.

– Anomaly Detection: This involves identifying outliers in transaction data. By examining typical customer behavior, such as spending habits or purchase locations, anomaly detection flags any significant deviations as potential fraud.

3. Neural Networks

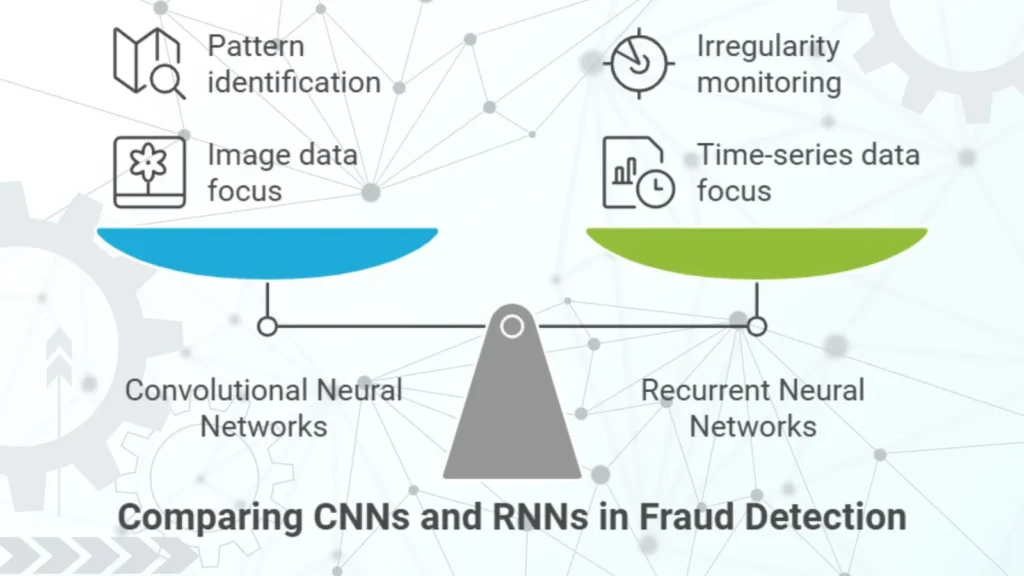

Neural networks are advanced machine learning models designed to mimic the human brain’s processing. They can analyze complex data patterns across multiple dimensions, which makes them particularly effective for fraud detection in high volume transactions, like those seen in e-commerce and banking.

– Convolutional Neural Networks (CNNs): Although primarily used for image data, CNNs have been adapted for transaction data analysis, to identify unusual patterns that could indicate fraud.

– Recurrent Neural Networks (RNNs): RNNs are ideal for time series data, which is useful in monitoring transactions over time for irregular patterns, such as repeated purchases in short intervals from various locations.

Popular Algorithms Used in Fraud Detection

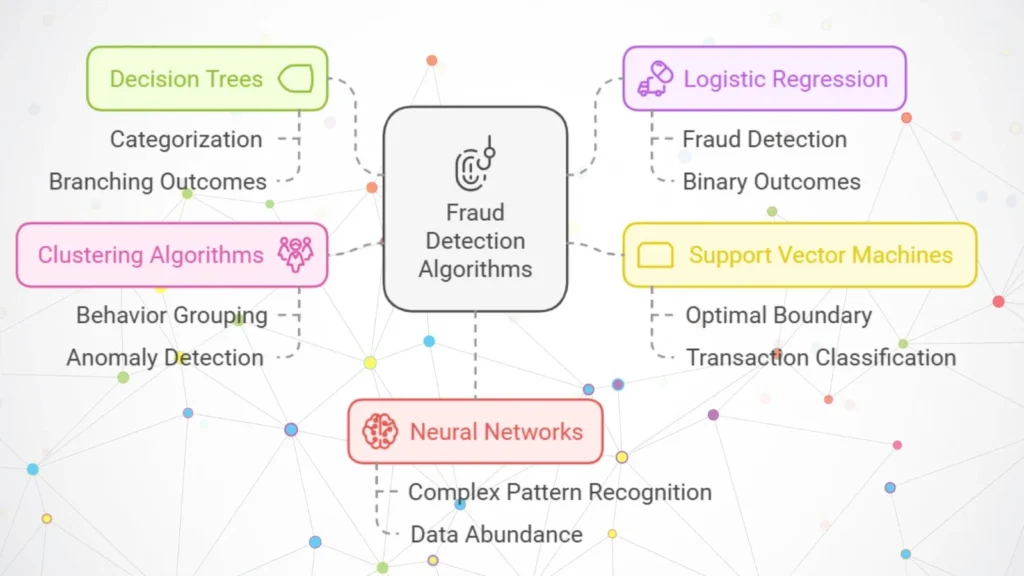

1. Decision Trees

Decision trees help categorize transactions by analyzing specific features and setting up “branches” that indicate different possible outcomes. They are relatively simple to implement and interpret, which makes them a popular choice in fraud detection applications.

2. Logistic Regression

Logistic regression helps in binary classification, where the transaction is either “fraud” or “non-fraud.” It’s widely used in cases with clear, binary outcomes and is often paired with other ML techniques for higher accuracy.

3. Support Vector Machines (SVM)

SVM models are effective for detecting fraud in datasets with clear boundary classifications. SVM finds the optimal boundary between fraudulent and non-fraudulent transactions, which enables accurate classification.

4. Clustering Algorithms (K-means, Hierarchical Clustering)

Clustering algorithms detect fraud by grouping similar behaviors. For example, in online banking, K-means clustering might group usual login locations together. When a transaction appears in a far-off cluster, it may trigger an alert for suspicious activity.

5. Neural Networks (Deep Learning)

Deep learning techniques, particularly neural networks, are highly effective at detecting complex, multi dimensional fraud patterns, especially when data is abundant. Many modern fraud detection systems incorporate deep learning algorithms due to their versatility and accuracy.

Real-World Applications of Machine Learning in Fraud Detection

E-commerce Fraud Detection

In e-commerce, ML algorithms are most valuable for detecting various types of fraud, such as payment fraud, account takeovers and return fraud. By analyzing user behavior patterns, purchase history and location data, ML models can flag unusual activities that may indicate fraud.

Example: Amazon uses machine learning to analyze buyer and seller activities on its platform, which identifies unusual purchase or refund patterns that may signal fraudulent intent. The ML system helps to prevent unauthorized purchases, which protects both Amazon and its customers.

Banking and Financial Services

Banks and financial institutions use machine learning extensively to detect and prevent fraud. ML models analyze transaction data in real time, to flag suspicious activities like stolen credit cards, unauthorized wire transfers, or identity theft.

Case Study: JPMorgan Chase

JPMorgan Chase employs machine learning to combat credit card fraud. The bank uses algorithms to analyze transaction data, by identifying anomalies in customer spending behavior. With ML’s predictive capabilities, JPMorgan Chase can quickly flag fraudulent transactions, which minimizes losses and protects customers’ assets.

Case Studies: Fraud Prevention in Banking

1. HSBC Bank

HSBC implements machine learning models to enhance fraud detection for its online banking services. The model uses a combination of anomaly detection and supervised learning, which analyzes customer behavior such as login times, transaction frequency and purchase types. As a result, HSBC has reduced its fraud rates significantly and improved customer trust and operational efficiency.

2. PayPal

PayPal, a leading online payment platform, relies heavily on ML algorithms for fraud detection. The company employs neural networks to examine millions of transactions daily, to identify subtle patterns that could indicate fraudulent activities. Through ML, PayPal has successfully reduced fraud rates, saved millions of dollars while ensuring secure transactions for its customers.

How Machine Learning Identifies Fraud

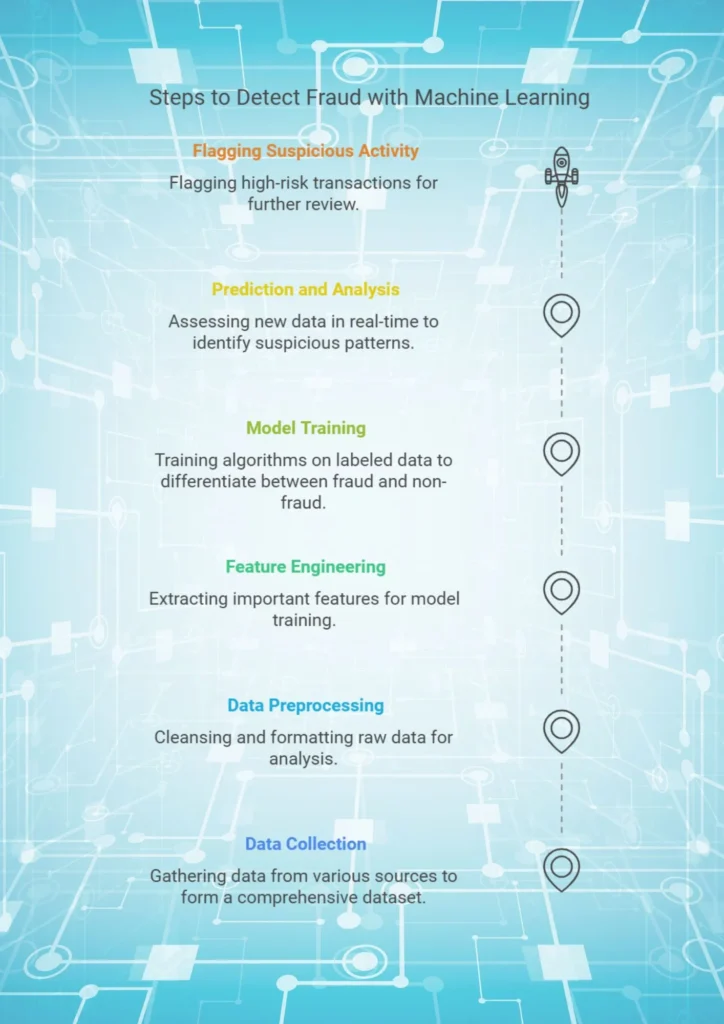

Here is a typical step by step process machine learning models undergo to detect fraud:

1. Data Collection: ML models gather data from transaction history, account behavior, login locations, etc.

2. Data Preprocessing: The raw data is cleansed and formatted, by removing outliers and preparing it for analysis.

3. Feature Engineering: Important features are extracted, such as transaction amount, time and geographic location.

4. Model Training: Algorithms are trained on labeled data to distinguish fraudulent from non-fraudulent transactions.

5. Prediction and Analysis: Once trained, the model assesses new data in real time, by identifying suspicious patterns.

6. Flagging Suspicious Activity: Transactions flagged as high risk trigger alerts or automatic reviews by security teams.

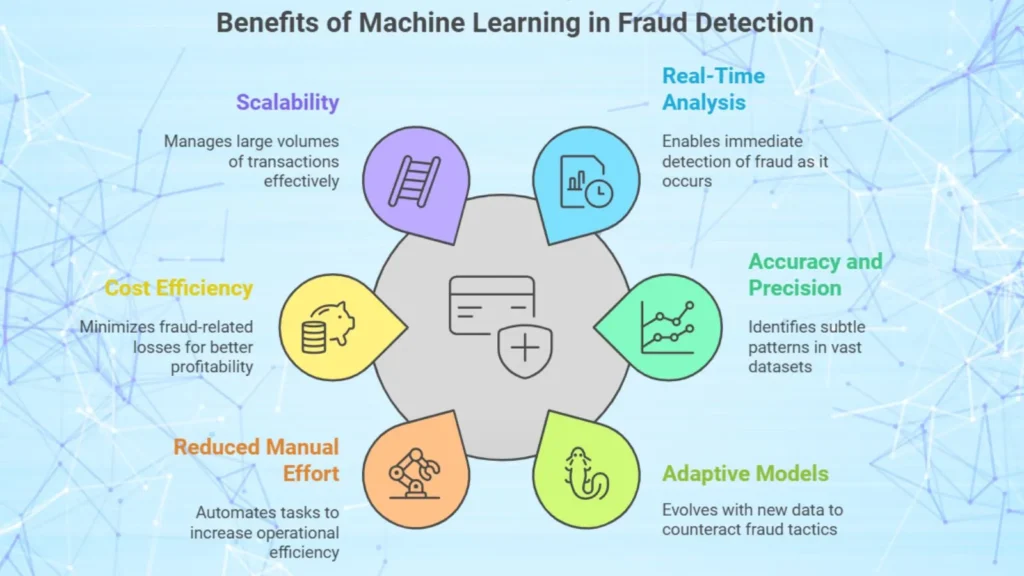

Benefits of Using Machine Learning in Fraud Detection

1. Real Time Analysis: ML algorithms process data instantly, which enables businesses to detect fraud as it happens.

2. Accuracy and Precision: ML models provide high accuracy by analyzing vast datasets and identifying subtle patterns.

3. Adaptive Models: Unlike static rules, ML models evolve with new data, which ensures that the systems are always prepared for the latest fraud tactics.

4. Reduced Manual Effort: Automated fraud detection reduces the workload on human analysts, which enables to make more efficient operations.

5. Cost Efficiency: By reducing fraud related losses, ML systems contribute to a company’s bottom line, especially in sectors like finance and e-commerce.

6. Scalability: ML systems handle vast volumes of data, which make them ideal for organizations that process high transaction volumes.

Challenges and Limitations of Machine Learning in Fraud Detection

While ML offers powerful tools for detecting fraud, it also has limitations:

– Data Quality: ML algorithms require high quality data for training and inaccurate data can lead to false positives or missed fraud cases.

– Model Interpretability: Deep learning models, particularly neural networks, are complex and can be difficult to interpret, which limits transparency in decision making.

– Risk of Adversarial Attacks: Hackers may exploit weaknesses in ML models by inputting misleading data to avoid detection.

– Evolving Fraud Techniques: Fraudsters constantly change their tactics, which makes it necessary to update ML models frequently.

– Complex Implementation: Implementing ML-based systems can be complex, which requires technical expertise and infrastructure.

Future Trends in ML Based Fraud Detection

1. Integration of Deep Learning Models:

As data grows in volume and complexity, deep learning models will become more prominent in fraud detection systems, which enables for more sophisticated analysis.

2. Increased Use of Graph Based Anomaly Detection:

Graph based ML models detect relationships between users and transactions, which provide insight into complex fraud networks.

3. Enhanced Customer Authentication:

Biometric-based authentication systems using ML will become more common, which helps to verify customer identities while preventing fraud.

Conclusion

Machine learning is revolutionizing fraud detection across industries by enabling real time detection, by reducing false positives and providing accurate insights into suspicious activities. From decision trees and clustering algorithms to complex neural networks, ML offers a versatile toolkit to fight against frauds.

With fraudsters constantly coming with new techniques, organizations must stay ahead by implementing adaptive, data driven ML models. The future of fraud detection is bound to become more sophisticated.

By implementing the right ML models and continuously updating them, businesses can stay one step ahead of fraudsters, to ensure a more secure environment for everyone.